|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

Understanding California Mechanical Breakdown InsuranceIn a state renowned for its sprawling highways and scenic drives, California residents are well-acquainted with the joys and challenges of vehicle ownership. While cruising along the Pacific Coast Highway with the wind in your hair is a quintessential Californian experience, the reality of unexpected car repairs can quickly turn a dream ride into a nightmare. This is where Mechanical Breakdown Insurance (MBI) comes into play, offering a layer of financial protection that many find indispensable. But what exactly is MBI, and how does it work? Mechanical Breakdown Insurance, distinct from traditional auto insurance, specifically covers the cost of repairs to a vehicle's mechanical components after a breakdown, rather than covering damages from accidents or collisions. MBI policies are designed to extend beyond the manufacturer's warranty, providing peace of mind when the inevitable occurs.

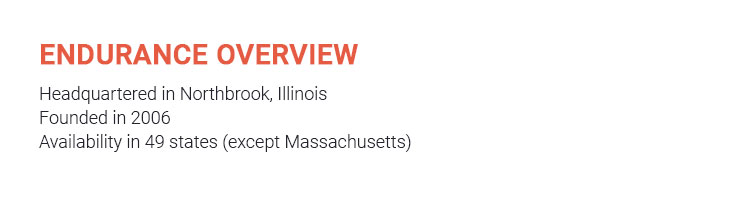

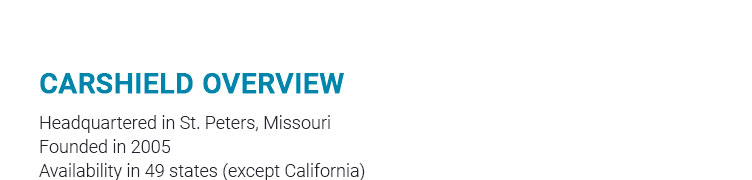

One might wonder, how does MBI compare with an extended warranty? Though they share similarities, an extended warranty is typically offered by the vehicle's manufacturer or a dealership, while MBI is provided through insurance companies. This distinction often means greater flexibility and potentially broader coverage options with MBI, although terms and conditions are again, variable. As with any insurance product, due diligence is key. Californians interested in MBI should shop around, obtain multiple quotes, and compare the fine print meticulously. Consider the reputation of the provider, customer reviews, and the ease of filing claims. In a market flooded with options, it pays to be discerning. Ultimately, the decision to purchase Mechanical Breakdown Insurance in California hinges on individual circumstances-vehicle age, driving habits, and financial situation all play pivotal roles. For those who decide that the security of MBI aligns with their needs, it can be a prudent measure to safeguard against the unpredictable nature of car ownership, ensuring that the allure of the open road remains untainted by the specter of costly repairs. https://www.endurancewarranty.com/mechanical-breakdown-insurance-ca/

Protect your California vehicle from unexpected breakdowns. Explore repair plans to fit your budget and get the custom coverage you need to start saving today. https://membercare.com/creditunions/products/mechanical-breakdown-insurance/

Mechanical Breakdown Insurance offers add-on mileage, no surcharges, high liability limits, and coverage for taxes, fluids, seals, gaskets, and diagnostics. https://wallethub.com/answers/ci/mechanical-breakdown-insurance-california-2140858866/

Milvionne Chery Copeland, Writer ... The best mechanical breakdown insurance in California is from Mercury, Geico, and Endurance. They cover many ...

|